bank of canada prime rate

In mid 2017 inflation remained below the Banks 2 target mostly because of reductions in the cost of energy and automobiles. For details please read our full Terms and Conditions.

2009 Longest period of no change.

. The prime rate in Canada is currently 245. Target for the Overnight Rate. Payments on some variable-rate mortgages will be adjusted higher in.

Our renewed monetary policy framework In 2021 we. Take a central role at the Bank of Canada with our current opportunities and scholarships. The prime rate is the lending rate Canadas banks and financial institutions use to set interest rates for variable loans and lines of credit including mortgages.

Related

This page provides - India Prime Lending Rate - actual values historical data forecast chart statistics economic calendar and news. Prime Rate Advertising Disclosure. Variable mortgage rates are based on the Prime rate which follows to the Bank of Canada target overnight rate.

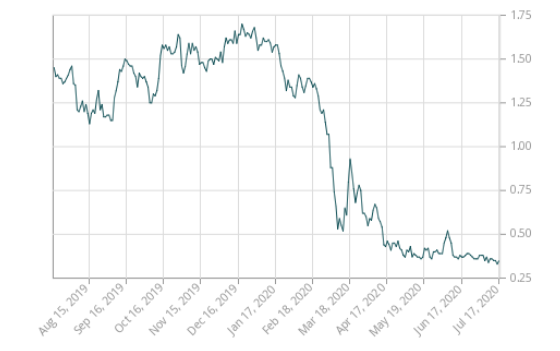

Bond yields immediately took a dip following the Bank of Canada announcement after the central bank kept the overnight lending rate unchanged at 025 per cent. The 5-year bond fell by over 0060 per cent from 1632 per cent in the minutes following the announcement while the 10-year bond fell over 0040 per cent from the 1794 per cent rate it held this morning. Bank Lending Rate in Canada averaged 709 percent from 1960 until 2022 reaching an all time high of 2275 percent in August of 1981 and a record low of 225 percent in April of 2009.

The central bank said it was increasing its key rate by a quarter of a percentage point to 05 per cent on Wednesday in a bid to help fight inflation which is at its highest level since 1991. Breadcrumb Trail Links. RBC and TD Bank say they are increasing their prime interest rate by 25 basis points following the Bank of Canadas rate announcement.

2015 Since the Bank of Canada started inflation targeting in 1991 the average Bank of Canada rate hike cycle has lasted 229 percentage points as measured from the trough to the peak as of September 2018. Bank Lending Rate in India averaged 1326 percent from 1978 until 2022 reaching an all time high of 20 percent in October of 1991 and a record low of 8 percent in July of 2010. The central bank said Wednesday it was.

Consequently Prime rates and variable mortgage rates are likely to also remain stable. A change in bank rates affects customers as it influences prime interest rates for personal loans. Get todays National Bank of Canada Prime Rate.

This page provides - Canada Prime Lending Rate - actual values historical data forecast chart statistics economic calendar and news. Since September 2010 the Bank of Canadas key interest rate overnight rate was 05. RBCs increase pushes its prime rate to 270 from 245 per cent effective March 3.

Home sales could drop 25 after Bank of Canada rate tightening study says. The increase in the prime rate which variable-rate mortgages are tied to will take effect on Thursday the lender said. The Bank of Canada has raised its key interest rate for the first time since slashing the benchmark rate to near-zero at the start of the COVID-19 pandemic in a.

RBC RY-T and TD Bank TD-T say they are increasing their prime interest rate by 25 basis points following the Bank of Canadas rate announcement. All Bank of Canada exchange rates are indicative rates only obtained from averages of aggregated price quotes from financial institutions. Increased competition in the mortgage sector may lead to discounts for.

Daily Nominal Canadian Effective Exchange Rates1. LB increases its prime lending rate by 25 basis points from 245 to 270 effective March 3 2022. Interest rates in Canadian and US Dollar.

The Bank of Canada said it would likely need to raise rates further to reduce inflation which hit 51 in January. The prime rate is in turn guided by the Bank of Canadas benchmark rate. Notes Interest rates are subject to change without notice at any time.

The central bank said Wednesday it was increasing its key. With overall economic slack now absorbed the Bank has removed its exceptional forward guidance on its policy interest rate said the Bank of Canada in a release. Many economists and traders expect the central bank to boost its key policy rate 25 basis points on Wednesday with more to follow.

Royal Bank of Canada will increase its prime rate to 27 from 245 Canadas biggest bank said on Wednesday after the central bank. MONTREAL March 02 2022 GLOBE NEWSWIRE -- Laurentian Bank of Canada TSX. About TD Banks prime rate.

By country Australia In Australia. The Bank of Canada defied market expectations by not raising its key overnight rate despite inflation at the highest level since 1991. Not for US dollar loans in Canada.

Our projections show that the BoC is unlikely to deviate from its current overnight rate of 025. Also the economy was in a. Share this article in your social network Share this.

The Bank of Canada. Exchange Rates 2022-02-25 2022-02-28 -USDCAD. Retail Payments Supervision.

And rate hike could come as early as next week. The rise in rates will increase the cost of loans such as variable-rate mortgages that are linked to. Royal Bank of Canada and Toronto-Dominion Bank are raising their prime interest rates after the Bank of Canada announced it is raising its benchmark interest rate for the first time since 2018The 25 basis-point increase by Canadas largest bank by market cap mirrors the Bank of Canadas hike taking RBCs prime rate from 245 to 270 per cent.

When the BoC changed the target for the overnight rate in July 2015 TD was the first bank to change its prime rate but it didnt pass on. TD Banks prime rate is currently 245. How aggressive will the bank be this year with inflation running at its highest in three decades.

The Bank is continuing its reinvestment phase keeping its overall. The prime rate also known as the prime lending rate is the annual interest rate Canadas major banks and financial institutions use to set interest rates for variable loans and lines of credit including variable-rate mortgages. The Bank of Canada could start a cycle of interest-rate hikes this week with its first increase since 2018.

Federal Reserve Cuts Rates To Zero And Launches Massive 700 Billion Quantitative Easing Program

U S Investor Optimism Rises Again Hits 17 Year High Strong Hand Optimism Optimistic

The Omnipresent Future Of Ecb Unconventional Monetary Policy Is Here May 19th 2018 Monetary Policy Omnipresent Policies

What Is The Current Prime Rate Credit Karma

Success Story Of Netflix Services Netflix Netflix Service Netflix International

Gbpusd Has The Primary Double Zigzag Ended Orbex Forex Trading Blog Forex Trading Pattern Forex

If Words Like Prime Rate Home Equity Line Of Credit Or Variable Mortgage Rate Aren T In Your Day To Day Vocab Mortgage Rates Mortgage Refinance Mortgage

Canada S Best 5 Year Fixed Rates Ratespy Com

See Interest Rates Over The Last 100 Years Gobankingrates

The Federal Funds Prime And Libor Rates Definition

This Week S Top Stories Canadian Real Estate Sees Supply Rise Faster Than Population Suspicious Money Soars Better Dwelling

One Three Five Year Fixed Mortgage Rate Mortgage Interest Rates Fixed Mortgage Mortgage Rates

Pin En Area De Toronto Canada Familia